Flexibility Will Wane Despite Persistent Challenges In Accurate Revenue Forecasting

A new survey of U.S. middle market financial trends conducted by Carl Marks Advisors revealed that banks and lenders, who have largely been more flexible with middle market borrowers during the COVID-19 pandemic, are likely to shift their attitudes by the end of Q1 2022. Most respondents, which included financial executives and advisors from across the U.S., believe that lenders are poised to act on outstanding loans for overextended businesses, or those that have shown themselves to be at risk for default.

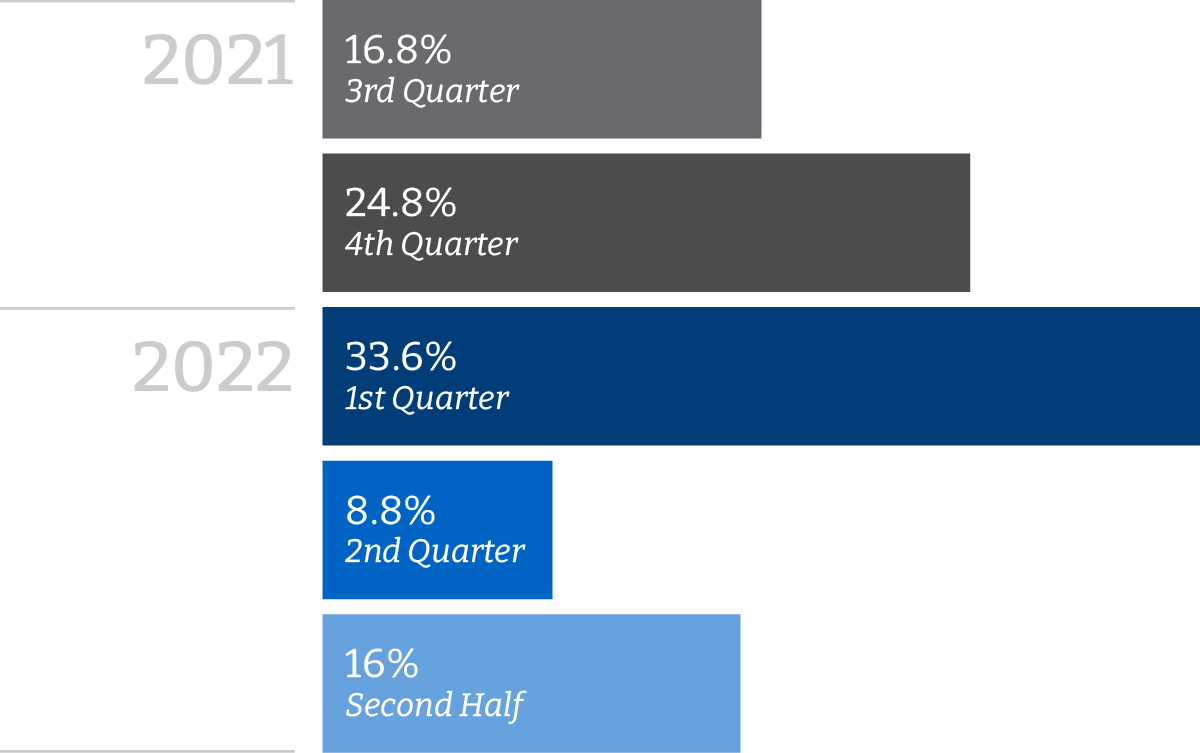

When Will Lenders Stop “Kicking the Can” on Loans to Underperforming Businesses?

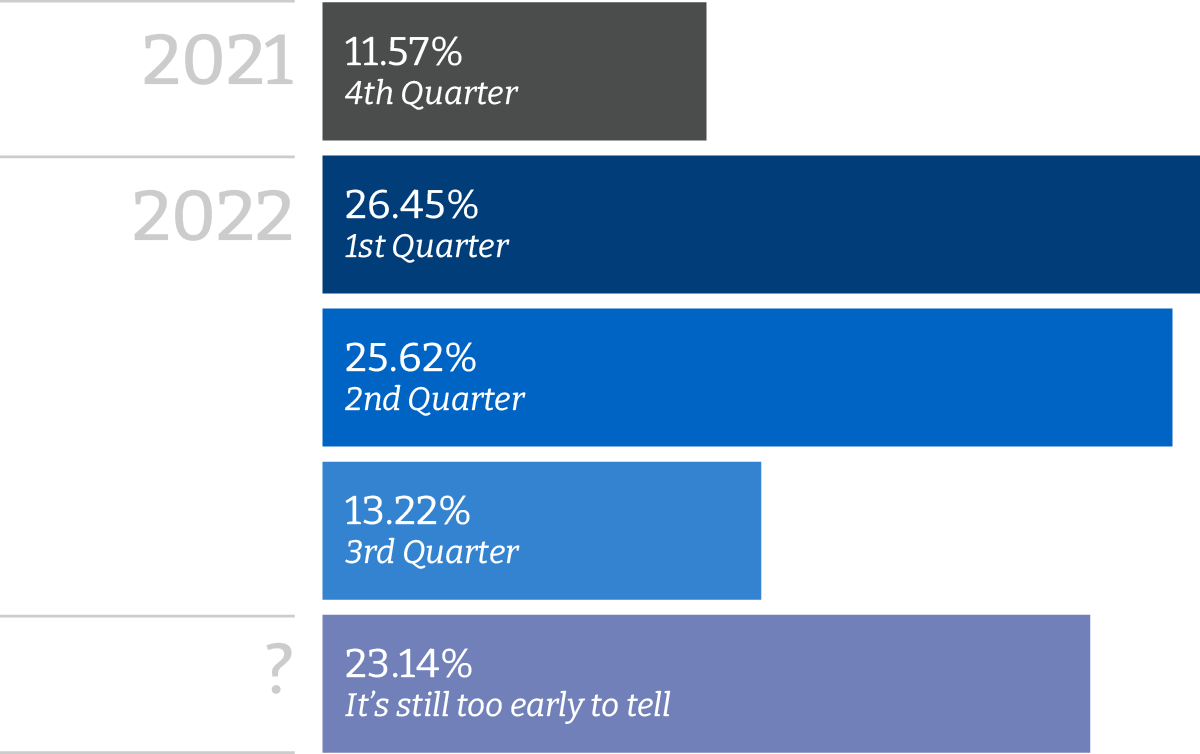

When Revenue Forecasting will “Normalize”

However, despite lenders growing impatience, respondents also recognize the complicated business environment we’re in. Less than 12% believe that revenue forecasting will normalize by year’s end.

Lenders have been more flexible than anyone expected over the past 18 months, in part because companies have been facing unprecedented challenges.

However, our survey shows we are approaching a pivot point where bankers and lenders feel it’s time to begin addressing excess leverage levels and lenient loan terms with borrowers whose future prospects are unsteady or unpredictable,” said Brian Williams, a Partner at Carl Marks Advisors, a leading middle market investment banking firm. “Survey respondents also agree that this process will be complicated significantly, as many companies haven’t been able to reliably forecast their revenues due to the impact of COVID, supply chain issues, labor shortages and other hurdles. This will make lender negotiations more difficult and contentious.”

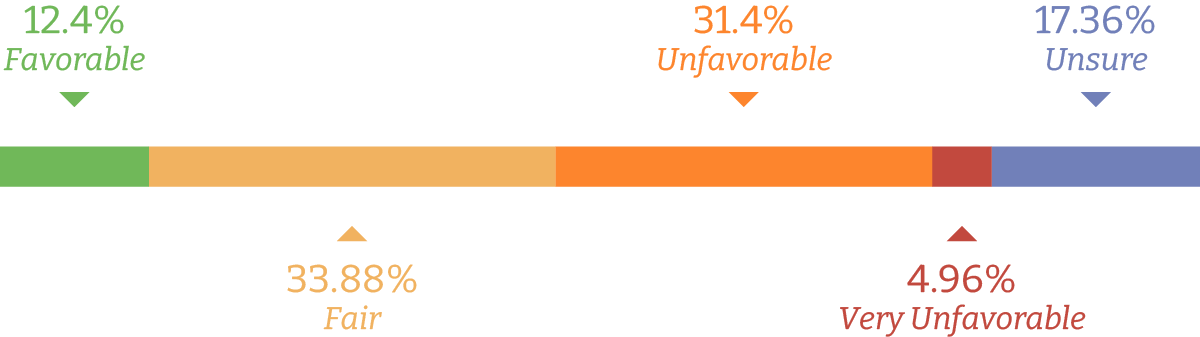

The dichotomy between lenders’ decreasing flexibility and challenges around accurate revenue forecasting may contribute to the lack of confidence respondents have around the ability of lenders to recover capital. In fact, less than 15 percent of those surveyed said that prospects are favorable for private lenders to recover their capital from middle market companies in the event of a default related to a pullback in the economy.

Prospects for Private Lenders to Recover Capital

About the Survey

Carl Marks Advisors conducted the online sentiment survey from June 30–July 16, 2021. In total, 125 responses were collected from financial services executives, advisors, and investors located across the United States and in a variety of industry sectors.