Optimism Tempered With Serious Concerns About Forecasting Revenues, Loan Default Rates

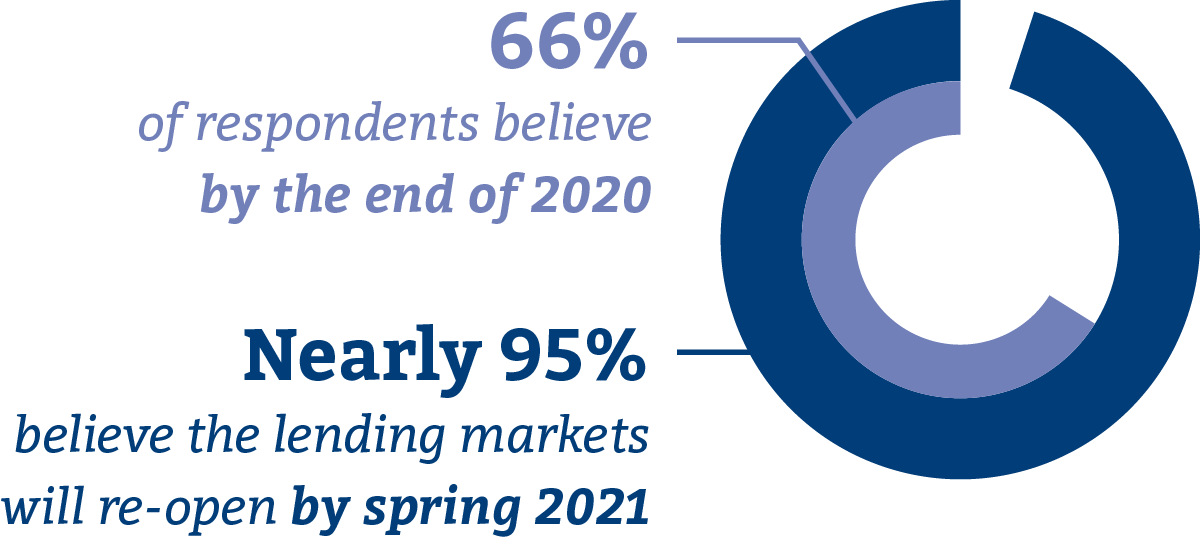

New York, May 14, 2020 – A survey of trends in U.S. middle market lending conducted by Carl Marks Advisors found that a significant majority of respondents believe the lending markets will reopen for well-capitalized companies by the end of 2020, but less than a third believe deal making will return to “normal” by year-end.

Key findings in the survey by Carl Marks Advisors, a leading investment banking and advisory firm, included:

66 percent of respondents believe the lending markets will reopen for well-capitalized middle market companies by the end of 2020.

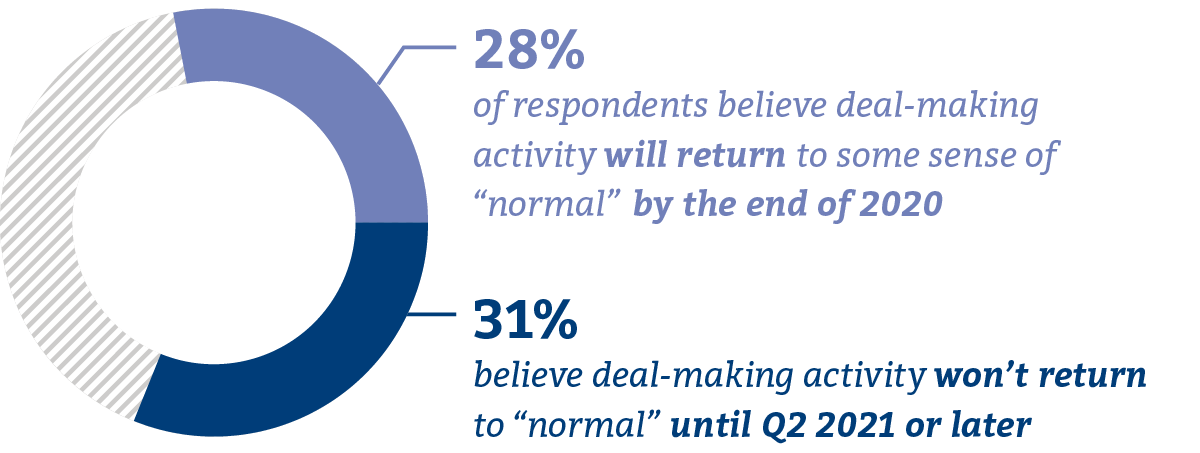

Only 28 percent believe deal making will return to some sense of “normal” by the end of 2020, while another 31 percent believe this will occur in Q2 2021 or later.

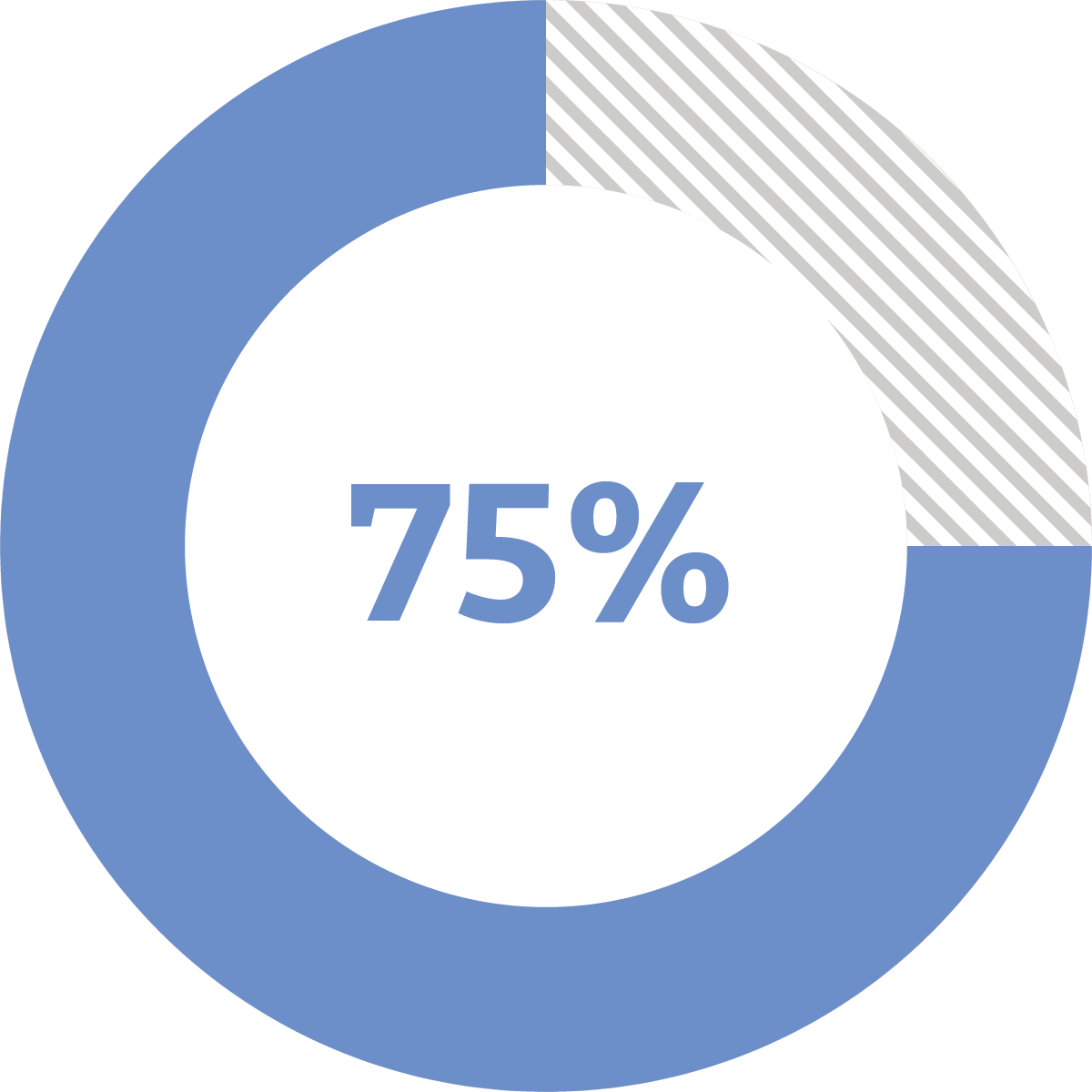

75 percent of those surveyed said it would be impossible or very difficult for companies to forecast their second quarter and 2020 revenues and cash flows at the present time.

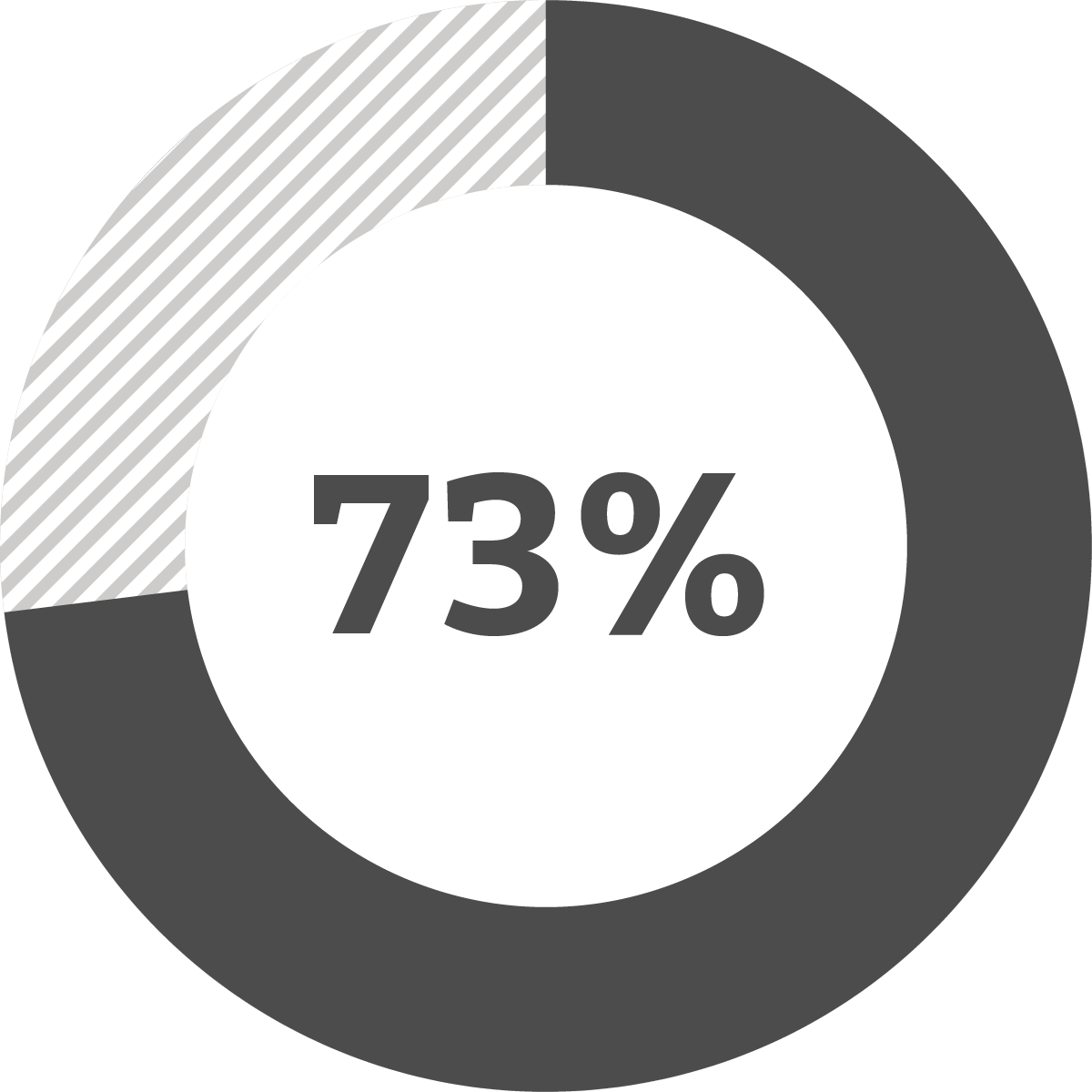

73 percent of respondents believe lenders will seek to “reset the market” in relation to leverage levels, pricing and terms based upon current events related to the coronavirus.

While the survey revealed optimism about a lending market rebound, the challenges of projecting revenues for the remainder of 2020 and into 2021 caused many respondents (75 percent) to forecast a loan default rate of 10 percent or more in the back half of 2020. The Carl Marks Advisors survey suggests that the economic dislocation caused by the pandemic will cause a dramatic increase in defaults for highly leveraged borrowers with non-investment grade debt.

“Unlike the 2008 financial crisis, which was very sector-specific, the COVID-19 pandemic affects nearly every area of the economy and much more deeply,” said Brian Williams, a Partner at Carl Marks Advisors. “Because of its universal impact, the vast majority of lenders are being more accommodating, with an understanding that we’re all in this together.”

Carl Marks Advisors conducted the online sentiment survey from April 16-26, 2020. In total, 117 responses were collected from financial services executives, lawyers, advisors, lenders and investors located across the United States and in a variety of industry sectors.