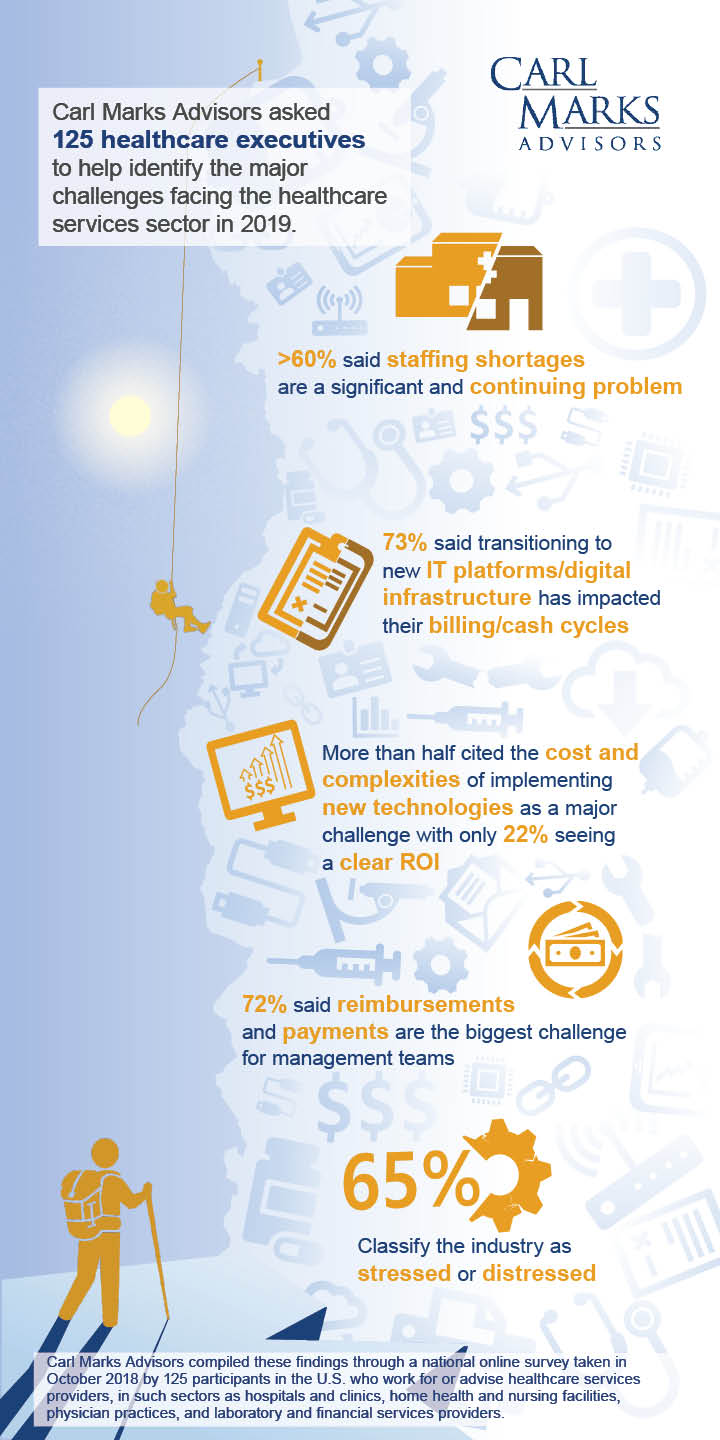

In October 2018, we surveyed 125 professionals who work for, or advise, healthcare services providers to better understand how the sector is adapting to change and stressors.

The results showed the sector is facing multiple challenges from insurance to increased M&A activity to distribution channels. At the top of the list though was the transition to new digital infrastructure.

Other findings include:

- M&A activity and price increases are two methods providers will employ to drive revenues in 2019, but restricted access to capital is likely forcing many to adopt more risk-averse growth strategies.

- Nearly 70% of respondents said less than half of healthcare services companies are operating with sophisticated, integrated IT systems.

- About 65% of those polled felt that while they recognize the need to upgrade technology infrastructure for the digital age, costly and inefficient fixes pose a major threat. There is significant concern that overspending on upgrades is rampant which ultimately affects billing and revenue cycles.

- While geographic expansion and the opening of new facilities are generally not seen as potential revenue drivers for healthcare services in 2019, respondents noted outpatient surgical centers and walk-in health clinics are likely to be exceptions that are expected to continue to expand.

If you’d like to learn more, contact one of our experts:

In the News:

To receive a full breakdown of the survey results, please email jkrattiger@carlmarks.com